Medicare Basics

Medicare is the federal health insurance program for:

People who are 65 or older, certain younger people with disabilities, or people with End-Stage Renal Disease.

As you enter the “World of Medicare” things will work a little differently than you may be used to with a major medical program. There are many important details regarding how the system works that you should know. Since Medicare will most likely be your main source of coverage for the next several decades, it would be valuable to have a good grasp of how it works and what you can expect.

Medicare Part A (Hospital Insurance)

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

More InfoMedicare Part B (Medical Insurance)

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

More InfoMedicare Part D (Prescription Drug Plans)

Helps cover the cost of prescription drugs (including many recommended shots or vaccines). If people choose to enroll in a Medicare Supplement Plan, they must add their drug/prescription coverage separately through a Part D Plan.

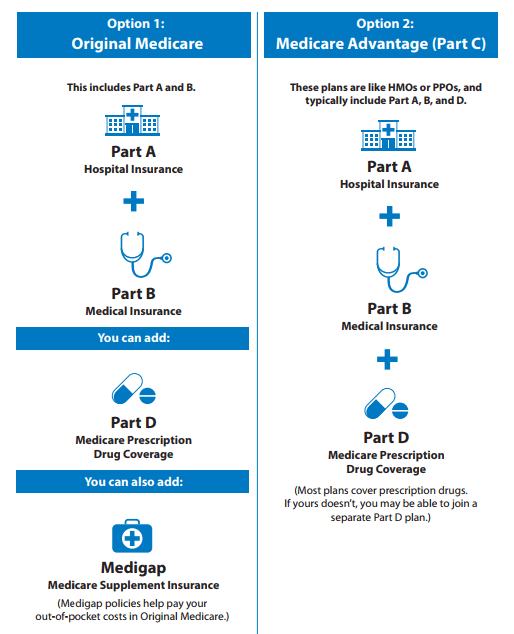

More InfoMedicare Part C (Medicare Advantage or MAPD)

Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage and may have lower out-of-pocket costs than Original Medicare. These "bundled" plans include Part A, Part B, and usually Part D. In most cases, you'll need to use doctors who are in the plan's network.

More InfoAnother important component:

Medicare Supplement Plans (Medigap)

Medicare Supplement Plans, or Medigap, helps fill "gaps" in Original Medicare and is sold by private companies. Original Medicare pays for much, but not all of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, such as copayments, deductibles, and coinsurance.

More InfoMedicare A & B Overview

What is Medicare Part A: Hospital Coverage?

Part A covers inpatient hospital stays, skilled nursing facility (SNF) stays, some home health visits, and hospice care. Part A benefits are subject to a deductible ($1,600 per occurrence for 2023). Part A also requires that you pay a daily coinsurance for extended inpatient hospital and approved SNF stays beyond 20 days.

What is Medicare Part B: Doctors Coverage?

Part B covers physician visits, outpatient services, preventive services, and some home health visits. In 2023, the Part B benefits are subject to an annual deductible of $226 and coinsurance of 20 percent. No coinsurance or deductible is charged for an annual wellness visit. After you meet your deductible for the year, you (or your Medicare Supplement Plan) typically pay 20% of the Medicare-approved amount for: Most doctor services (including most doctor services while you're a hospital inpatient), Outpatient therapy, and Durable medical equipment (DME).

How do I get Parts A & B?

Some people get Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) automatically and other people have to sign up for it. In most cases, it depends on whether you're getting Social Security benefits. If you are not collecting Social Security and need to apply for your Medicare A & B benefits, you can do so up to three months prior to your Medicare start date. Click here to go directly to Social Security’s Medicare landing page, where you can apply for your Medicare benefits online.

https://www.ssa.gov/benefits/medicare/

When will my coverage start?

If you sign up for Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) during the first 3 months of your Initial Enrollment Period, your coverage starts the first day of the month you turn 65. If your birthday falls on the first day of the month, your coverage starts the first day of the prior month.

Should I get Parts A & B?

Most people should enroll in Medicare Part A (Hospital Insurance) when they're first eligible, but certain people may choose to delay Medicare Part B (Medical Insurance). In most cases, it depends on the type of health coverage you may have or whether you or your spouse are still employed and have credible coverage through that same employer. Make sure you review your situation carefully to understand how "opting out" or dropping Part B would affect you. Here is a useful fact sheet that may help guide you through this decision-making process.

Whether to Enroll in Medicare Part A and Part B

If you are considering delaying your Medicare Part B, we always recommend contacting Social Security directly to discuss your individual situation.

https://www.ssa.gov/agency/contact/

Part A & Part B Premiums

Most people don’t pay a monthly premium for Part A You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Everyone pays a monthly premium for Part B. Most people will pay the standard Part B premium amount. The standard Part B premium amount in 2023 is $164.90. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your Part B and Part D premiums.

Click here to learn more about IRMAA

Common Medicare Enrollment Periods

Adding Additional Health or Drug Coverage

There are specific times when you can sign up for a Medicare Advantage Plan (Part C) and/or Medicare prescription drug coverage (Part D), or make changes to coverage you already have. The most common enrollment periods are:

When you first get Medicare (Initial Enrollment Periods for Part C & Part D)

If you are newly eligible for Medicare because you are turning 65 or you have recently retired are new to Part B.

- When:

- During the 7-month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

- During your IEP you can:

- Sign up for a Medicare Advantage Plan and/or a Medicare Prescription Drug Plan.

During the annual enrollment periods for Part C & Part D

Each year, you can make changes to your Medicare Advantage or Medicare prescription drug coverage for the following year. There are 2 separate enrollment periods each year:

- Annual Election Period (AEP) for Medicare Advantage and Medicare prescription drug coverage

- When:

- Each year from October 15—December 7. Any plan changes or new elections made during the Annual Election Period will take effect January 1st and run through December 31st of the next calendar year.

- During your AEP you can:

-

- Change from Original Medicare to a Medicare Advantage Plan.

- Change from a Medicare Advantage Plan back to Original Medicare (A & B).

- Switch from one Medicare Advantage Plan to another Medicare Advantage Plan.

- Switch from a Medicare Advantage Plan that doesn't offer drug coverage to a Medicare Advantage Plan that offers drug coverage.

- Switch from a Medicare Advantage Plan that offers drug coverage to a Medicare Advantage Plan that doesn't offer drug coverage.

- Join a Medicare Prescription Drug Plan.

- Switch from one Medicare Part D plan to another Medicare Part D plan.

- Drop your Medicare prescription drug coverage completely.

- Medicare Advantage Open Enrollment Period

- When:

- Each year from January 1-March 31

- During your MA OEP you can:

-

- If you’re in a Medicare Advantage Plan, you can switch to another Medicare Advantage Plan.

- You can drop your Medicare Advantage Plan and return to Original Medicare A & b. You will also be able to join a Medicare Prescription Drug Plan.

- You cannot:

-

- Switch from Original Medicare to a Medicare Advantage Plan.

- Join a Medicare Prescription Drug Plan if you're in Original Medicare.

- Switch from one Medicare Prescription Drug Plan to another if you're in Original Medicare.

Special circumstances (Special Enrollment Periods)

You can make changes to your Medicare Advantage and Medicare prescription drug coverage when certain events happen in your life, like if you move, lose other insurance coverage, or your Medi-Cal or Extra Help status changes. These chances to make changes are called Special Enrollment Periods (SEPs). Rules about when you can make changes and the type of changes you can make are different for each SEP.

Click here to see a list of Qualifying SEP's.

Medicare Advantage Plans (MAPD)

A Medicare Advantage Plan, MAPD, or "Part C", operates more similarly to traditional insurance. It becomes your main insurance coverage -- the "advantage" being that you hand over one card at the doctor, hospital, or pharmacy.

The second option that Medicare Beneficiaries have are called "Medicare Advantage Plans" otherwise known as "MAPD" or "Part C" of Medicare. You must be eligible/enrolled in your basic Medicare A & B to be able to have a Medicare Advantage Plan. These plans may also come with additional ancillary benefits. The trade-off, so to speak, is that folks will not use their Medicare card as their primary insurance, and they would need to make sure their doctors accept the plan.

Medicare Supplement Plans (Medigap)

A Medicare Supplement plan works as a secondary coverage to your Medicare A & B coverage. Medicare Supplement Insurance helps fill "gaps" in Original Medicare and although these plan benefits are standardized by Medicare, plans are sold by private insurance companies. Original Medicare A & B pay for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments, Coinsurance, and Deductibles

Once people enroll in Medicare at age 65, they will choose between two separate paths for additional coverage options. One, is to add a "Medicare Supplement Plan" that will work as a secondary coverage to their Medicare A & B. This option will require the addition of a standalone Medicare Part D plan that will cover prescription medications. The second, is to enroll in a "Medicare Advantage Plan" which already includes a credible Medicare Part D plan. With Medicare and a Medicare Supplement plan, people can go to any doctor and any hospital as long as they accept Medicare. In recent years, it has become more common for doctors to cap the number of Medicare patients they accept under their practice, so it is important to keep in mind that if you are in search of a new doctor you should inquire whether or not they are accepting "new" Medicare patients. For people who split their time between two different homes in different states, or for clients who see many doctors in different physician groups or counties, this option may be the most suitable. These plans are "standardized" by Medicare, and any carrier who offers these "lettered" Medicare Supplement Plans must offer the same benefits. The main difference between companies offering these plans is the monthly premium, and the "ancillary" benefits offered by some insurers -- such as Silver Sneakers Fitness Membership, vision, dental, and hearing benefits. Premiums are also rated by age and some carriers will also offer a spousal discount. We broker through all of the main carriers to provide the most comprehensive plans with the most robust ancillary benefits, at the lowest rates.

Medicare Supplement Insurance (contd.)

Some Medicare Supplement policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, here's what happens:

- Medicare will pay its share of the Medicare-approved amount for covered health care costs.

- Then, your Medicare Supplement policy pays its share.

Important Medicare Supplement Facts

- You must have Medicare Part A and Part B to get a Medicare Supplement

- Medicare Supplement plans are standardized by Medicare, so a lettered plan with one company has the same benefits as the same lettered plan with another

- Medicare Supplement companies can offer "extra" benefits to its members, such as Silver Sneakers, hearing, dental, vision, or NurseLine, but these extra benefits are not part of Medicare's standardized coverage.

- A Medicare Supplement policy is different from a Medicare Advantage Plan. Medicare Advantage Plans cover your Part A, B and D benefits, while a Medicare Supplement policy only supplements your Original Medicare A and B benefits and would require you to add Part D separately.

- You pay the private insurance company a monthly premium for your Medicare Supplement policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. You will always need to pay your Part B premium, even if you enroll in a Medicare Advantage Plan

- You cannot have a Medicare Supplement plan and a Medicare Advantage plan at the same time

Medicare Part D Plans (PDP) Insurance

How to get prescription drug coverage

To get Medicare drug coverage, you must join a Medicare plan that offers prescription drug coverage. Each plan can vary in cost and formularies (drugs covered).

2 ways to get prescription drug coverage

- Medicare Prescription Drug Plan (Part D) . These plans (sometimes called "PDPs") add drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service (PFFS) Plans.

- Medicare Advantage Plan (Part C) like an HMO or PPO, or other Medicare health plan that offers Medicare prescription drug coverage.

Part D is a drug/prescription coverage that must be added if you chose to enroll in a Medicare Supplement plan.

If people choose to enroll in a Medicare Supplement plan, they must add their prescription drug coverage separately. These stand-alone prescription plans are called "Part D" plans and although Medicare conducts oversight on these programs, Part D plans are actually offered through private insurance companies. There are 30 Medicare Part D options and attempting to shop and compare plans on your own can be overwhelming. I assist my clients in selecting the plan that is the most suitable for them by entering a list of their prescription medications into a program that will compare all 30 plan options and organize them in order of the lowest premium plan with the lowest copays for my client's particular medications, to the highest cost plan.

Compare Standalone Part D Plans

Our Partners

Just a few of the partners we are able to offer products and services from: